The Money App That Could Help You Take Control Of Your Finances

Capital at risk. Your investments can go down as well as up.

What It Is

During such economic uncertainty, Plum is a practical solution designed to help everyone improve the long-term health of their finances. Driven by AI and automation, Plum lets you save up for big life moments, invest for your future in stocks, funds and a self invested pension plan (SIPP), and manage your everyday spending with a debit card. In short, downloading Plum will help you look at your money through a 360° lens, so you can feel more confident about managing your incomings and outgoings on a daily basis.

Capital at risk. Your investments can go down as well as up.

The Mission

Money can be confusing, taboo and sometimes stressful – especially nowadays. With almost half of adults experiencing money anxiety (source: Plum), changing course and moving towards full financial freedom can feel utterly daunting. It’s Plum’s mission, therefore, to make managing your money feel like second nature. By providing automated saving, investing and money management tools, it wants to empower people to transform their money into something more.

Capital at risk. Your investments can go down as well as up.

How It Works

Saving

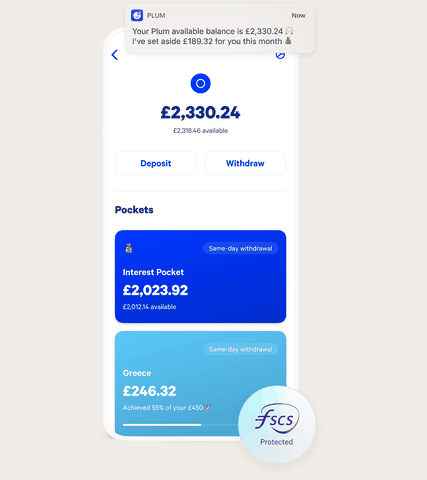

With its automated features and smart technology, Plum gives you total control to help you reach your financial goals. Just download the app, create an account, connect your bank account(s) and set up your smart rules to get started. These automatic rules will help you save money by telling the app to set aside a certain amount of cash from your bank account at regular intervals. You can customise everything – from the timing of these deposits to the goals you have in mind.

Capital at risk. Your investments can go down as well as up.

Investing

For those who want to start investing but don’t know where to begin, Plum makes it accesible. With Plum, you can start your investing journey or diversify an existing portfolio. Choose from a range of more than 20 funds, including ‘Tech Giants’ and ‘Rising Stars’, and invest in more than 1,000 US companies (stocks). Users can set up their Plum account to automatically invest part of their income each month, making regular investing a new financial habit.

*Capital at risk. Your investments can go down as well as up.

Spending

You can order your Plum Card on the app and follow the steps on the home screen to activate it once it arrives. From there, load your Plum Card with money from your Primary Pocket or linked bank account and start tracking your spending while still moving towards your financial goals. The Plum Card is also powerful tool that can help users fight the urge to impulse buy and overspend.

Capital at risk. Your investments can go down as well as up.

Where To Download It

You can download the Plum app here or by scanning the QR code below.

Visit withplum.com

DISCLAIMER: Your capital is at risk when you invest. Your investments can go down as well as up. Anything written by SheerLuxe is not intended to constitute financial advice. The views expressed in this article reflect the opinions of the individuals or third parties referenced, not the company. Always consult with an independent financial advisor or expert before making an investment or personal finance decision.

DISCLAIMER: We endeavour to always credit the correct original source of every image we use. If you think a credit may be incorrect, please contact us at info@sheerluxe.com.