My Investing Journey: Sarah Larson

My husband Tom and I have been married for 15 years. We have three children aged 13, ten and eight and we moved into our dream ‘forever’ home in Wandsworth last year. Now, we’re about to embark on an ambitious renovation project. When we bought the house, we knew we had a comfortable level of savings behind us – not only to help fund the purchase – but also to see us through the renovations.

There’s no way we could have made our dream home a reality if we hadn’t set good financial habits. About a year into our marriage, my husband and I opened a cash ISA. We weren’t together that long before we were married, and we’d agreed to keep all of our finances separate until we were husband and wife. Since then, we’ve also set up a stocks and shares ISA and last year we decided to set up a lifetime ISA, too, so we can start investing for our long-term future. There are obviously tax limits on how much you can invest per year, but we try to max out those limits so we can take advantage of the tax breaks.

By saving and investing regularly in that cash ISA, we were able to buy our first home about two years into our marriage. It coincided with the birth of our first son, so it was a bit stressful to say the least, but without that little bit of investment and some help from both our parents towards the deposit, it would have taken us far longer to get a foot on the property ladder. We stayed in that house for the best part of a decade, but eventually decided to move into something with a bit more space – especially outdoor space – where we could also spend some time making it exactly right for us.

Other financial commitments we have this year are a couple of family holidays. After the last couple of years, we could all do with a bit of a change of scene. This summer we’ll be going to Italy for two weeks, renting a villa with family friends, then we hope to take the children skiing after Christmas. We tend to pay for these trips out of our joint account.

My husband works in insurance in the City – he earns a salary in the low six figures – and I work as a freelance marketing consultant about two days a week. We both make monthly contributions to this joint account, which we can both access any time, and tend to use it most for covering shared, family expenses – be it the mortgage payment, bills, school fees and anything else that crops up regularly.

Because I’m self-employed, I’ve also had a self-invested personal pension (SIPP) for several years now. My husband’s pension contributions are managed by his company, but what I like about SIPPs is you’re not restricted to pension funds offered by any single pension provider. Instead, you can invest in a broad range of investments from different providers. Returns are also protected from income tax, tax on dividends and capital gains tax (CGT).

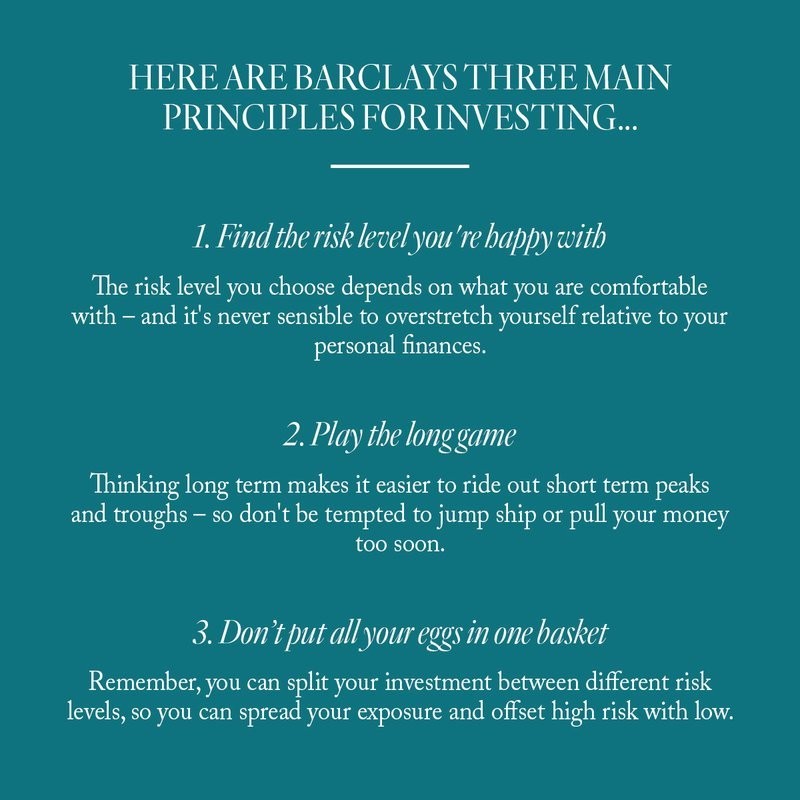

From time to time, my husband and I take professional financial advice. Tom is pretty savvy given his job, but it always helps to get some outside perspective – neither of us are experts in this field. I also think it’s important to get some professional advice on the investments which are solely in my name. Women sometimes get a reputation for being a little bit more risk averse – and I’ve certainly been guilty of that in the past. Now that Tom and I feel more established and we’re on a sounder financial footing, I feel like I can get comfortable with a new level of risk to make my money work harder. I’m hoping to learn a bit more about that in the coming year or so.

School fees and university costs are something that loom large in my mind. Our eldest just started a new school, and ideally I’d like the other two to follow him there. It’s fee paying and we also want them to be able to take advantage of every opportunity offered to them – be it school trips, events or work experience. Until they’re old enough to get a Saturday job and start supporting themselves a little bit, Tom and I want to be able to pay for what’s necessary.

Spending time as a family, even just as weekends, is another reason we take saving and investing seriously. It means we can do fun things – like go out for breakfast, visit National Trust parks and spending days at amusement parks, child-friendly museums and other things like that. Of course, all of these things cost money, so it’s good to have some money tucked away each month which we can put towards spending quality time all together.

Day to day our expenses tend to cover things like: my husband’s travel costs to and from work. He’s been back at the office full time since February, so that’s taken some getting used to again. When he heads off, it’s time for me to crack on with the school run – two children to one school, one to another – and I probably don’t need to explain what it’s like trying to drive around London at that time. Petrol costs are obviously something which have taken more of a bite out of our disposable income lately, as has the general cost of living. Even our food shop the other day felt far more expensive than it used to.

It's for this reason we’ve cut down on discretionary spending where we can. The pandemic has helped us realise what we need and don’t need, so I don’t spend nearly as much on clothes or beauty products as I used to. I still enjoy the odd treat, but I prefer it to be experiential –whether that’s a manicure, a massage or getting my hair done. Equally, I’m not as interested in buying things for the house until the renovation is complete. I’d prefer to put that money towards dinners out or things we can share together.

To combat the rising cost of living and to make sure we stay secure while we progress with our renovation, I’m definitely looking into other ways I can make our money go further. In the past, I’ve also been very focused on investment products that offered income whereas now I feel like I can take on growth products, too. All in all, I like the idea of being able to build a portfolio of investments that reflect my lifestyle, mirror my own financial goals and is ultimately designed to make those goals a reality.

For more educational content about investing and to find out if Barclays has an investment match for you, visit Barclays.co.uk.

DISCLAIMER: Remember, investing is not for everyone. With investing, your capital is at risk and the value can fall as well as rise. Anything written by SheerLuxe is not intended to constitute financial advice. The views expressed in this article reflect the opinions of the individuals, not the company. Always consult with an independent financial advisor or expert before making an investment or personal finance decisions.

DISCLAIMER: We endeavour to always credit the correct original source of every image we use. If you think a credit may be incorrect, please contact us at info@sheerluxe.com.