My Investing Journey: Rachel Patterson

My husband and I had our first child last year. We’ve been together for 11 years, living together for nine, married for eight, and we bought our first house five years ago. Right now, the cost of childcare is pretty full on but long term we want to start saving for our daughter’s future, as well as things like family holidays and private school. I’m due to return to work soon, so we’re currently looking at nurseries close to where we live in Chiswick and seeing what kind of cost that might incur.

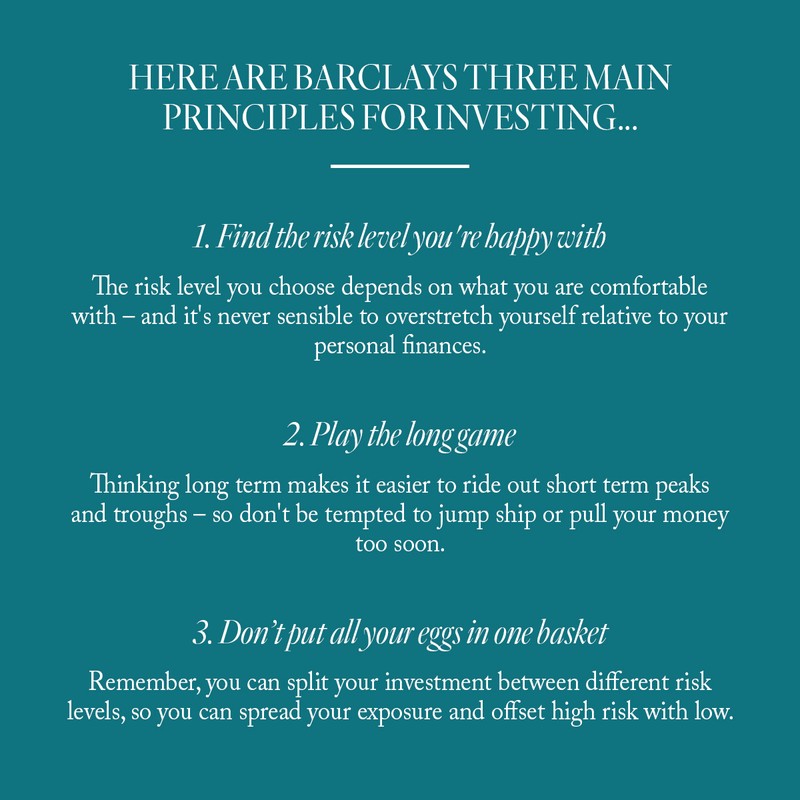

I’ve been disciplined about putting money into a stocks and shares ISA for years. After the house purchase went through, it would have been tempting to stop saving and instead put most of the money towards repairs and redecoration. We’ve done a bit of that – albeit gradually – but I’ve continued to put money away. As it stands, there’s probably about £28,000 in that account. I’m proud to say that I’ve been able to play the long game and reap the rewards. The minute we started talking about having a family, I knew it was wise to have some money accumulating. Hopefully these are all healthy financial habits I can pass onto my daughter someday.

It's great that we’re already on the property ladder. We bought our house in 2017, with a bit of help from our parents, plus the money we’d saved for about seven years prior in a cash ISA. My dad, who worked in the City, always insisted on us having a nest egg – and because we committed to saving and investing, he was willing to help out. He’s also Nigerian, and as an immigrant to this country, he was insistent on forging his own path, making his own money and passing that work ethic onto my brother and me.

There have been a few bumps along the road in my investing journey. Back in the day, I put about £10,000 into a high interest savings account with an Icelandic bank, only for it to go bust after the 2008 financial crisis. Thankfully, I’d done my homework and the bank was covered by the Financial Services Compensation Scheme (FSCS). I made sure I didn’t invest over £85,000, so that when things took a turn for the worse, I was able to recover the funds. I’ve never had a huge appetite for risk, but I do like to get the highest return possible – so it’s a balancing act.

When our daughter was born, I took it upon myself to look into a children’s savings account. You can usually set aside as much as you want, whenever you want and earn interest. Through online banking and an app, I can keep track of where the figure stands. The plan is to contribute to it monthly – there’s no maximum balance and you can access the money anytime. Not that we plan to touch it – this is the start of her own nest egg to fund whatever she wants in the future.

I’d love to get a bit more advice on saving for children. We want our daughter – and possibly any more children we have – to have the best possible start we can give them, and we know we have to start now and be consistent. It’s not an area in which I’d like to take many risks, so I’d like some guidance on the products or options which might fit the bill. It might be something as simple as a Junior ISA, which I’ll definitely be investigating sooner rather than later.

Our daily expenses have changed considerably since having a child. My husband works in advertising in East London, so he makes good money – about £65,000 a year – and I’ll be going back to full-time work (I work in recruitment) at the end of the summer. Together, our annual household income is close to £150,000, plus bonuses. Even so, we used to spend a lot at weekends on things like going to the cinema or for dinners out. That’s changed – now we tend to spend money on things we can do as a family, like brunch instead of dinner, and we’ve also learnt to make the most of things that are free, like going for long walks by the river.

Life in Chiswick is more relaxed. When I was younger, I rented a flat in central London, and there was far more pressure to be out in the evenings and at weekends. You always felt like you had to keep up with all the fun your friends seemed to be having. These days, we’ve moved out a bit – not so far that we don’t have everything London has to offer on our doorstep – but weekends are a quieter affair, often spent with other parents and families who live in and around the neighbourhood.

At some point, we might like to move up the property ladder. Right now, our house works well for a family of three, and we could squeeze in four. But if we have three children, we’d probably have to move somewhere bigger. It’s something my husband and I talk about already – but it’s a long-term goal, and for the time being, our priority is finding our new financial rhythm as parents of a one-year-old. We’re also aware of the size of our current mortgage. Debt is something I take really seriously – I always have – so I’m determined to pay a good chunk of it off before we consider moving.

I wouldn’t say I feel totally financially comfortable yet. Our standard of living is good, but I value my career and I’m aware I’m the main breadwinner – so I know I need to find the right balance to be a successful working mother. I’m proud to say I’ve acquired some good financial knowledge over the last few years, but I’d now like to capitalise on that knowledge the best I can, especially for my children’s sake.

There are some things I enjoy spending money on just for myself. They’re not things that overstretch us by any means – I’m talking mainly about my SoulCycle membership and regular facials and nail appointments – but they do make me feel good. Having something that feels like mine definitely makes me happier and more productive – so really, we all benefit.

If I do invest more, I’d like to find a service that feels unique and personal to me. By that, I mean I’m happy to track things day-to-day online – I’m already familiar with online banking and apps – but it would be helpful to know there’s a real person at the end of the phone who’s happy to help me when I need it, especially as the economy is in a real period of transition right now. I’m aways happy to stick with a bank or a service that I feel is serving my needs well, but I’m also happy to switch if things aren’t working for me or my family’s future.

For more educational content about investing and to find out if Barclays has an investment match for you, visit Barclays.co.uk.

DISCLAIMER: Remember, investing is not for everyone. With investing, your capital is at risk and the value can fall as well as rise. Anything written by SheerLuxe is not intended to constitute financial advice. The views expressed in this article reflect the opinions of the individuals, not the company. Always consult with an independent financial advisor or expert before making an investment or personal finance decisions.

DISCLAIMER: We endeavour to always credit the correct original source of every image we use. If you think a credit may be incorrect, please contact us at info@sheerluxe.com.